Painters Madison WI

Madison Painting Company

#1-Rated Painters Madison WI

Finding a great Madison painting contractor or house painter in Madison, WI can be tough. Fortunately, 3rd Gen Painting and Remodeling has homeowners in Madison & nearby neighborhoods like Fitchburg and Verona covered.

3rd Gen has been rated the #1 house painter in Madison by local Madison homeowners just like you. Admittedly, when it comes to 3rd Gen being the best Madison Painting contractors, the proof is in the paint job.

Our award-winning professional painting crews in Madison have earned dozens of 5-star interior & exterior painting reviews in the past year alone. Isn’t it time you expected more from your local Madison house painter?

3rd Gen’s Painters in Madison WI Recent Awards

- “Best Of Service Award” from Houzz (Category: Interior & Exterior Painters in Madison WI).

- The #1-Rated Painting Contractor in the State of Wisconsin (and the #8 best rated Wisconsin business across ALL industries in 2019) by TopRatedLocal.com

- Threebestrated’s Top Interior and Exterior House Painters in Madison, WI

What Painting & Remodeling Services Do You Offer in Madison?

3rd Gen Painting and Remodeling is well versed in a variety of home painting and remodeling services in Madison, Wisconsin including:

- Exterior House Painting

- Interior Painting

- Commercial Painting

- Drywall Installation

- Deck Building & Deck Repairs

- Trex Decks & Composite Decking Installation

- AZEK & TimberTech Composite Deck Builds

- Trim & Finish Carpentry & Woodwork

- Kitchen, Basement, & Bathroom Remodeling

The Premier Madison Painting Contractor

What sets 3rd Gen apart from other house painters in Madison, WI? It’s no secret the highest quality paint jobs require excellent attention to detail.

But on top of that, the Madison painting company you choose must have a commitment to providing an amazing customer service experience. You need a painting contractor in Madison that treats your home with respect and is able to hit project deadlines every time.

We may be biased, but our friendly & professional exterior painters are simply the best that Madison have to offer. Through detailed prep work & great communication,

As a result, 3rd Gen was rated the #1-rated house painter in Madison on sites like Yelp, Houzz, & AngiesList. Bottom line? 3rd Gen Painting and Remodeling in Madison knows quality interior & exterior house painting.

Over 100 5-Star House Painting & Deck Building Reviews

Madison Painting Contractors Who Take Pride in Prep Work

As we mentioned briefly, the best house painting contractors in Madison know that a quality paint job is more than slapping paint on the wall or trim.

The key to a quality exterior paint job relies on extensive PREPARATION of the surface area before painting (80% of a quality paint job is prep).

In a nutshell, by ensuring each surface is properly cleaned, scraped, sanded, caulked, and primed before applying the first coat of paint, our house painting projects simply last longer than your typical paint job.

How Do I Find A Great Exterior Painter in Madison?

The key to finding a good house painter comes down to one thing. Prep work – but not just the kind we complete.

With that in mind, here are the most important things to consider when prepping for your search for exterior house painters.

The Early Bird Gets the Best Painter

Savvy homeowners in Madison know the best exterior painters in Madison book up early. To reserve a spot with a great Madison house painter, you’ll need to start getting your estimates in as soon as March or early April at the latest.

As an added perk, booking early allows for scheduling flexibility.

Oh – and finding a painter early is essential if you have a painting completion date in mind (i.e. before your annual 4th of July party).

Prepare for Your Painting Estimate

Taking 15 minutes to do a bit of exterior painting research online before your estimate will go a long way in finding a great exterior painter.

This includes educating yourself on what goes into a great exterior paint job, which will help you set great expectations with your future painting contractor.

Hint: Proper prep work before any kind of painting is done is the #1 most important aspect of a quality exterior paint job.

Additional Exterior Painting Resources for Homeowners in Madison:

Be Sure To Meet Your Painter in Person

Certainly, being at home during the painting estimate is important if you want to find a great home painter.

You are likely a good judge of character so meeting your painting contractor face-to-face can be really helpful to make sure their communication skills are up to par.

Lastly, because you did your homework on exterior painting beforehand, you’ll know exactly what to look out for. But what specific questions should you ask each painter?

Questions To Ask During Your Painting Estimate

Knowing what questions to ask during each house painting estimate is the last aspect in finding a great interior or exterior painter.

Great questions to ask your painter include:

- Do you have both liability insurance AND Workers comp? (You could ask for copies and check for valid documents.)

- What exact steps will you take to prep my home for painting?

- What kind of workers do you have on your crews? Where do you find them and do you do background checks?

- What kind of warranty do you have on your exterior painting work? (This may be different from the paint warranty details themselves.)

- How long will my painting project take?

Painters in Madison With Award-Winning Customer Service

Above all, our award-winning Madison house painters are committed to providing a great customer service experience.

With this purpose in mind, they will respect your home and actually LISTEN to your specific needs and incorporate them immediately.

In other words, we treat your exterior painting project (or any home improvement project, for that matter) as we would our own!

Not to mention, our reputation as the best reviewed local Madison painting company is on the line every single day.

(Click Number Below to Call)

(608) 620-4680

Madison Painters That “Get” Customer Service

Let’s be frank, painting a house isn’t rocket science. It certainly doesn’t take a genius to paint your peeling trim or patch a few holes in your drywall. Given that, why do so many local homeowners have bad experiences when it comes to working with Madison painting contractors?

Evidently, running an exceptional painting business is more than just painting a wall or caulking a corner. It just takes one rude painter on a crew to completely ruin the experience for you as a homeowner.

Our Painters Make Us Great!

Recruiting and retaining incredible painters and crew leads is what 3rd Gen does best. We’re proud to say our friendly & professional painters are our “secret sauce” when it comes to being a top-rated painter in Madison.

That’s why you can always depend on a 3rd Gen Painter at your home… our painters understand what it means to provide incredible customer service.

In like fashion, our painters will gladly walk you through every step of the exterior painting process. From putting up exterior paint color samples before the start of painting to performing a full clean up at the end of your exterior painting project, they have you covered.

Our painters will gladly walk you through every step of the exterior painting process. From chatting through your exterior paint sample options before the start of painting to performing a full clean up at the end of your exterior painting project, they have you covered.

Finally, to show you how confident we are in our workmanship, we back each painting project with a 2 year guarantee for 2 coat paint jobs.

Have trouble finding the perfect home paint color combo? No worries, our new paint color guide may be a great place to start!

3rd Gen Painting and Remodeling Madison WI

2201 Carling Dr #101

Madison, WI 53711

(608) 620-4680

Mon-Sun 8:00 AM – 7:00 PM

Proudly Owned & Operated in Madison WI

About 3rd Gen Painting and Remodeling in Madison WI

Meet the 3rd Gen Team. They are Dane County’s neighborhood house painting, deck building, & remodeling experts.

They strive to provide a better, stress-free experience for homeowners in the Madison area.

Learn more about the 3rd Gen Difference.

100% Licensed, Insured, & Full Workers Comp Coverage

(Click to Call Below)

(608) 620-4680

3rd Gen Painting’s Local Madison Review and Profile Links Online:

Exterior Painting Guide

Generally speaking, summer marks the beginning of the exterior painting season for both house painting contractors & savvy homeowners alike.

As we progress through each season, you’ll notice signs of wear on your home’s exterior. But when do you know it is time to paint versus waiting one more year?

Luckily, you can find the answer to that question and many more in 3rd Gen’s Homeowner’s Exterior Painting Guide (Spring 2023 Edition).

With our trusty exterior painting guide, you can be 100% confident and ready to protect your home every season.

Exterior Painting Guide: Table of Contents

1. When is The Best Time of Year to Paint House Exterior?

2. How Long Does an Exterior Paint Job Last?

3. How Many Coats of Paint Do I Need?

4. What Is The Best Exterior Paint?

1. When is the best time of year to paint your house exterior?

Up until recently, 50 degrees or above was the general rule when it came to exterior house painting. Due to recent advances in paint technology, you may be able to apply paint outdoors in 35-degree weather using a special low-temperature paint.

Having said that, we wouldn’t risk anything below 40-45 degrees. In our opinion, it is better to be safe than sorry when it comes to painting the exterior. Conversely, the highest recommended temperature you can apply exterior paint is 90 degrees with an advisable relative humidity of 35% to 75%.

Why does temperature matter when it comes to exterior painting?

Paint simply doesn’t dry properly when it is too cold or too hot. Consequently, this leads to peeling and paint adhesion issues down the line.

To be clear, what is the best time of year to paint your house? Well, it depends on when you are located.

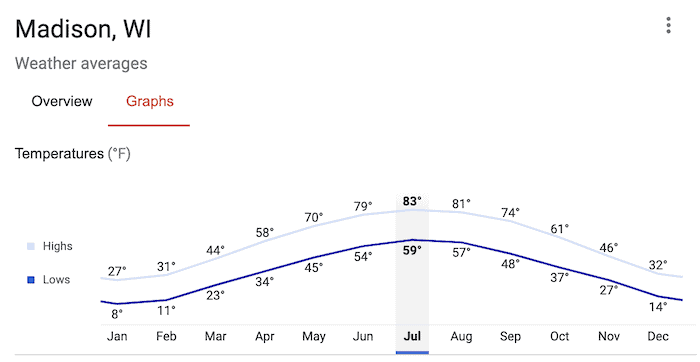

For example, our company 3rd Gen Painting is Madison-based, so let’s check the average temps here.

Based on this, the typical exterior painting season in Madison begins April/May and runs until October/November, depending on how mother nature is treating us that year.

While we can absolutely paint during the summer (June-Aug) in the Midwest tends to be hot and super humid, the best time to paint is actually in the Springtime. That said, fall comes in a close 2nd-place when it comes to the best house painting conditions.

2. How long does exterior paint last?

The average exterior house paint job lasts about 5 years. Although, the longevity of your paint job will vary based on a number of factors including your climate and the amount of surface prep work performed before painting.

Best case scenario, a quality paint job can last up to 6-11 years; however, some exterior surfaces (if prepared and coated properly) can last up to 15 years!

On the flip side, a failing surface area that hadn’t been prepared properly may barely make it past the first winter. As you can imagine, factors like prep work and using the right paint generally comes down to the quality of house painting contractor you hire (a factor you can control).

3. How many coats of paint do I need?

Okay, so I am going to fill you in on some pretty valuable insight we have learned over the past decades of painting homes.

All things considered, opting for two coats vs one coat of paint may possibly be the best long-term decision you can make for your home (and for your wallet). Here are some of the most important reasons why you should opt for that second coat of paint.

A. The 2nd Coat Can TRIPLE The Life of The Paint Job

That’s right, a quality two-coat paint job can TRIPLE the lifespan of your paint job vs applying a single coat.

The reason why is simple: Many exterior surfaces on your home are quite porous (wood, brick, cement, etc). In like fashion, exterior surfaces dry out over time as they are battered with rain, sun, and every other outdoor element you can imagine.

Generally speaking, your first coat of paint fills the worn out, porous exterior surfaces. These worn surfaces act like a sponge and soak up the 1st coat.

Your 1st Coat Allows The 2nd To Do Its Job

Consequently, your second coat of paint goes on way smoother and looks noticeably more consistent following the initial coat. Furthermore, paint colors are noticeably richer and you can be confident that your home is protected from the elements.

In short, your first coat of paint allows the second coat to do its job properly as it works to both beautify and protect exterior surfaces. Likewise, your 2nd coat is able to provide ample resistance to moisture, fading, and future paint breakdowns that, in turn, maximizes the life of the paint job.

B. A 2nd Paint Coat Makes Colors Look Fantastic!

Like we briefly mentioned, opting for a 2nd coat ensures that the new or current paint color really pops on your home.

A two-coat paint job helps make colors richer and more vibrant. Regardless of whether you are sticking with the same color or changing colors, your home will look considerably better with a 2nd coat. That said, the benefits of a 2nd coat really shine through most when you change colors. Painting two coats completely opens up the spectrum of colors you can choose from. Put simply, you won’t have to worry about the original color showing through the top coat when you opt for 2nd coat.

C. Your Second Coat of Paint Costs You Less

A second coat typically costs 30-40% less than your first coat coat of paint and for good reason.

First, you save a ton on labor and materials as areas are already masked and taped from the 1st coat.

Next, there is no need to scrap sand or prime failing paint again as all prep has been performed before the first coat was applied.

All in all, we’ve learned that a 2nd coat triples longevity, makes paint colors look twice as vibrant, and costs 40% less.

Still not convinced? No worries, here is one more important yet often overlooked benefit of a 2nd coat.

D. A 2nd Coat Is Needed To Qualify For Paint Warranties

Did you know that most paint companies offer up to a 30-year warranty on chemical failures of its paint?

Yep, it’s right there in fine print on the paint can. Sherwin Williams, Benjamin Moore, and most reputable paints carry similar warranties on their exterior paint.

The manufacturer warranty basically protects you in case there is a chemical breakdown in the paint which actually happens more often than most people think. To get even more specific, the warranty protect you from things like premature fading, bonding issues, and curing issues after the paint dries.

Also found in the fine print are the conditions required to qualify for your paint warranty. Certainly, one of which is (you guessed it) the application of a two coats of paint.

E. Your Second Coat Should Extend Your Painter’s Warranty

Most reputable painting contractors should a written guarantee of labor and materials to back the quality of their work. These warranties can range from 1 year to 2 years. Normally, any warranty over 2 years requires two or more paint coats. As you can imagine, this will really save you down the line in case your paint starts peeling prematurely.

Hopefully, you choose a reputable contractor that will come out free of charge within the warranty period to prep and repaint the failing areas. Now, you just have to find one you can trust will be in business that long (which is another story altogether).

Prep Work Is The Best Work

All things considered, the most important factor in a paint job that lasts is the amount of prep work performed.

The top 3 prep work tasks that affect paint job longevity most are:

- The washing of the home’s exterior surfaces before painting

- Amount of scraping, sanding, & priming of failing paint surfaces

- Caulking, sealing, and priming areas of bare wood and cracks

A painter may have 30 years of experience, but if they aren’t willing to roll up their sleeves & prep, you are going to have issues down the line… regardless of how many coats they apply.

4. What Is The Best Exterior Paint?

The type of paint you choose for your exterior has a major impact on the longevity of your paint job.

Generally speaking, higher quality exterior paints like Sherwin Williams’ Emerald exterior paint or Aura exterior paint by Benjamin Moore, tend to last longer. As you might have guessed, they also happen to have a higher price tag (upwards of $75 per gallon!).

There are two things to keep in mind though. First, even the most expensive or best house paint can’t make up for a lack of prep work (feel free to insert your favorite “lipstick on a pig” idiom here). Secondly, different types of exterior surfaces on homes (wood, metal, Hardie-board) have their own quirks when it comes to painting. Nonetheless, the type of paint you use & the amount of recommended coats vary based on the surface being painted.

House Painting Color Guide

So I am sure everyone has heard some of the stats regarding the effect of paint colors on your home’s value.

You know, basically the title of every click-bait home improvement article you’ll find on the internet including:

- Exteriors of homes painted towards the “greige” (gray-beige) paint color family sold for $3,496 more than homes painted brown

- Light blue or grayish blue bathroom colors add $2,786 to a home sale price (this one is kinda interesting)

- Living rooms with light taupe wall colors with pink or peach undertones typically sell for $2,793 more than expected

- Learn more about the cost of painting your home

Look, we aren’t ALL trying to put our homes up for sale tomorrow.

Therefore the paint colors you pick for your home’s exterior should instead reflect your personal color preferences and styles.

In any case, here are some of the up and coming paint color trends you’ll be hearing all about:

Grays are Getting Warmer We’ve seen a notable transition towards the warmer side of the paint palette recently. The latest popular gray color palettes have subtle warmed tones that pair well with more earthy paint color schemes throughout the home.

See the Forest for the Trees (Literally) Lighter bark shades and earthy leaf tones mark a turn towards the warmer side of the paint swatch spectrum. Combine that with natural texture of a stone backsplash or fireplace and you have a full-on natural color trend. Furthermore, Sherwin Williams’ 2023 Color of the year, Redend Point SW9081, is a great tone to bring the warm vibes of the outdoors inside. Sherwin describes it as “a soft neutral that is highly flexible and imparts cozy warmth & natural earthiness.”

Sweet Coral-ine (bom bom bom) Coral paint color shades are more than a silly Neil Diamond song pun these days. Coral and pale pink tones are serious contenders for the breakout color of the year. Coral can inject some much-needed energy into your home’s paint color palette and is officially on the map this year.

We’ve got the Powder Blue Powdery or hazy light blue tones are more than just great color tones for bathrooms & coastal designs. They can be a great backdrop if you are going for a more tranquil, zen-inspired modern or contemporary style in your room.

3rd Gen Painters Madison WI Reviews

Madison Painting Homeowner Resources

With over 100 5-Star house painting reviews online, 3rd Gen Painting is, without a doubt, the #1 reviewed house painter in Madison WI, and Dane County of 2023!

3rd Gen has a 5-star rating on sites like Yelp & Angieslist

For one thing, our painters and carpenters take a lot of pride in the customer service and quality of work they provide and it shows. Their attention to detail is unmatched and has helped make us one of the best rated painting companies in Madison.

Whether we are doing simple drywall repairs and painting a wall in your living room or building a composite deck in your backyard, our goal is to earn a stellar review from each of our painting or remodeling clients.

Keeping our top spot as one of the top rated painting companies in Madison isn’t going to be easy. However, I have a feeling our painting and remodeling crews are up for the challenge!

Looking For Painting Jobs in Madison WI? We Are Always Hiring Great Painters

Painting Jobs Madison WI | Painting Subcontractor Jobs Madison WI

Looking to work as a painter, house painting crew chief, or painting subcontractor for Wisconsin’s #1 rated painting company?

Navigate over to the Madison Jobs and Careers page to apply for a carpentry job in Madison online.

Furthermore, if you are a painting subcontractor looking for extra interior and exterior painting work in Madison this season, do not hesitate to reach out. Apply online using our painting subcontractor jobs page for more details about working with us as a subcontractor.

Not to mention, our painting subcontractors page is full of useful tips on how to find great margin painting work & which painting companies are best to partner with.

Talented Deck Contractors in Madison WI

We offer more than house painting and deck re-staining! Our deck crews in Madison WI do incredible work & will help design & build the exterior wood or composite deck of your dreams! We are experienced in working with top-quality exterior wood / treated lumber products as well as composite decking brands like AZEK, TimberTech, & Trex Decking.

If you’re interested in a screen porch, 3 or 4-season room, or a new deck, be sure to check out our decking page to learn more!